For Richer or for Poorer

Working Together on Finances

Debra Theobald McClendon and Richard J. McClendon, "For Richer or for Poorer: Working Together on Finances," in Commitment to the Covenant: Strengthening the Me, We, and Thee of Marriage (Religious Studies Center, Brigham Young University; Salt Lake City: Deseret Book, 2018), 231–258.

Debra: No couple, regardless of income level, can escape the management and negotiation of finances. Like most couples, we have had to negotiate different approaches to finances, particularly during our first years of marriage. Richard, as a longtime bachelor, was accustomed to having money at his own disposal for spending as he saw fit. He was a frequenter of fast-food restaurants, and he spent his money on a variety of hobbies, such as golfing, biking, and skiing. The circumstances of my family of origin and my time as a single mother led me to a frugal financial style of counting every penny and continually distinguishing between needs and wants—and usually not buying the wants. In our first years of marriage, Richard’s purchase of real butter or BYU Creamery ranch dressing irked me because I saw these more expensive items as luxury items. Admittedly, I would complain to Richard that he was wasting our money.

Although I did not value the items Richard valued, I did value decorating my home to create a comfortable environment in which I could feel the Spirit. Richard would never have chosen to use his money to purchase home décor and was satisfied with mismatched furniture. He could not understand why I would be upset by his trips to McDonald’s and Krispy Kreme Doughnuts for relatively minuscule purchases when I might desire to spend a much larger amount of money on a piece of furniture.

We had to conscientiously work through these and other issues relative to our finances. Some issues were resolved fairly smoothly, while others continued to crop up repeatedly over many years. Yet we now enjoy unity. We continue to have real butter and BYU Creamery ranch dressing in the refrigerator, Richard enjoys his doughnuts and fast food, and we also have a comfortably decorated home. When larger financial issues arise, we are now able to work through them without competition and argument.

Credit: 123RF

Credit: 123RF

Financial habits or beliefs are a cultural issue, rooted largely in our family of origin. Perhaps you come from an affluent family and your spouse comes from a middle-class or lower socioeconomic-status family. Perhaps you come from a large family that was always struggling financially, while your spouse comes from a small family in a comfortable middle-class setting. Or perhaps you and your spouse both come from lower-income households, but your parents accepted long-term Church assistance or government welfare, while your spouse’s parents worked three jobs to make ends meet, never taking any financial assistance from outside sources. These cultural differences, and the myriad of other financial constellations within marriage, require a great deal of sensitive attention because they affect our ability to come to agreement about how to generate income and manage our expenditures.

Specific dollar amounts do not generally cause the difficulty in marital unity; the difficulty lies in how we make decisions together about those dollar amounts. For those who do not learn how to negotiate this vital aspect of their marriage in a healthy way, severe trouble often comes. Finances represent one of the strongest predictors of marital unhappiness and eventual divorce. In a 2012 study examining finances and divorce, researchers analyzed longitudinal data from more than 4,500 couples as part of the National Survey of Families and Households. They found that arguing about money was the top predictor of divorce regardless of income, debt, or net worth. The research also found that, relative to marital conflict, arguments about money were longer and usually more intense than other types of marital disagreements.[1] Thus, the trouble that comes for couples who do not work well together financially may very well endanger the long-term survival of the marriage. In order to avoid such difficulty, we now discuss several principles that will assist couples as they seek stability and marital unity in finances.

Finances Belong to the Couple

It is critical that both husband and wife be informed and actively involved in the family finances. Although one partner may hold the task of paying the bills for simplicity’s sake, both partners should be equally aware at all times of what is going on with the money. Paying bills or loans, making investments, and the like should be openly discussed on a frequent basis.

In a booklet published by the Church on finances, Elder Marvin J. Ashton indicates: “Management of family finances should be mutual between husband and wife in an attitude of openness and trust. Control of the money by one spouse as a source of power and authority causes inequality in the marriage and is inappropriate. Conversely, if a marriage partner voluntarily removes himself or herself entirely from family financial management, that is an abdication of necessary responsibility.”[2]

Unfortunately, far too often women have taken a back seat in this area—either of their own choosing by leaving everything financial to their husbands or by being strong-armed by their husbands, who have unilaterally taken everything upon themselves. Financial expert Suze Orman explains to all women, “Your becoming involved with the finances is not about him giving up power or questioning his abilities. It is about your need to be knowledgeable and involved. To share responsibility with him.”[3]

For couples that live on the income of the husband alone, there needs to be a particular sensitivity to the issue of finances relative to their respective roles. Many stay-at-home moms “equate a paycheck with power”[4] and thus feel they have no or limited power in their relationship since their work is not financially compensated. Orman strongly declares to these women:

Listen up and listen good: The job of the stay-at-home mother is equal to the job of the breadwinner. Please read that again. Your job is important, as vital, and as necessary as that of your husband who earns a paycheck. . . .

. . . No stay-at-home mom should ever have to ask for money or feel guilty about spending money. To behave that way presumes that the money coming in is “his.” It is not his, it is yours. Both of yours.[5]

Let us remember the counsel from the Church’s family proclamation that we are obligated to help each other in our relative stewardships “as equal partners.”[6] In an eternal relationship, no one holds 51 percent of the authority, while the other holds only 49 percent. In an eternal marriage, each partner has equal authority, equal power, and equal say-so, for the partners are absolutely, unequivocally equals. If there is a power differential in your marriage, you will likely recognize the difficulties this creates not only in your financial relationship but throughout your relationship in general. Financial decisions should be discussed and then pursued only when there is agreement between both partners. This too will strengthen the quality of the marital relationship, as feelings of shared purpose and partnership are bolstered.

Richard: Debra and I have always worked together on our finances. It has been a tremendous blessing both to our marriage and also in the building of financial stability. Debra’s financial discipline has rubbed off on me, and because of this cooperative pattern, we have been able to be far more financially efficient than if we had tried to make financial decisions separately. In addition, there have been a number of occasions when we have felt that because we have pondered and consulted together, the Lord has directed and protected us financially as well. We will share one of these experiences in chapter 9 when we discuss the value of pondering together as a couple over financial decisions.

Principles of Provident Living

Over the years, the Church has promoted several basic financial principles of provident living. Five of these principles are specifically helpful when applied to marriage; they include paying tithes and offerings, avoiding debt, using a budget, building a reserve, and teaching family members. We will now examine each of these principles and discuss how they might help in strengthening and protecting marriage.

Pay Tithes and Offerings

The foundational principle of financial security, whether you are married or not, is to pay tithes and offerings. “To tithe is to freely give one-tenth of one’s income annually to the Lord through His Church.”[7] The Lord offers a promise to those who trust Him with their finances. We read in Malachi 3:10, “Bring ye all the tithes into the storehouse, that there may be meat in mine house, and prove me now herewith, saith the Lord of hosts, if I will not open you the windows of heaven, and pour you out a blessing, that there shall not be room enough to receive it.” We firmly believe in this promise.

Although paying tithing is a fundamental practice in and of itself, paying a generous fast offering can sometimes be overlooked. President Spencer W. Kimball said the following in reference to the idea of making a liberal donation:

Sometimes we have been a bit penurious and figured that we had for breakfast one egg and that cost so many cents and then we give that to the Lord. I think that when we are affluent, as many of us are, that we ought to be very, very generous. . . .

I think we should be very generous and give, instead of the amount we saved by our two meals of fasting, perhaps much, much more—ten times more where we are in a position to do it.[8]

Let us consider generous offerings when we discuss with our spouse the budgeting of our tithes and offerings.

It seems paradoxical that living with less money can bless us with both temporal and spiritual surplus. Yet God blesses those who faithfully obey this commandment. Indeed, it is “God that giveth the increase” (1 Corinthians 3:7). Although we use our income to pay tithing, it is much more than that. It has been said that “we pay tithing with faith and not with money.”[9] Many couples can testify of Malachi’s promise that as they give, the windows of heaven open up. We have personal witness that the Lord fulfills His promises: “For he will fulfil all his promises which he shall make unto you, for he has fulfilled his promises which he has made unto our fathers” (Alma 37:17). He has truly blessed us not only temporally but also spiritually because we have put Him first in this commandment.

Perhaps one of the most fascinating findings in recent years that confirms the blessings of giving comes from the research of Arthur Brooks, a well-known economist and president of the American Enterprise Institute. Brooks found that charitable giving has a strong relationship to personal wealth and health and that an increase in wealth is directly related to how much one gives. This seems counterintuitive. Yet, over the course of several types of research studies, Brooks found that same answer again and again—giving leads to receiving. Brooks explained: “If you have two families that are exactly identical—in other words, same religion, same race, same number of kids, same town, same level of education, and everything’s the same—except that one family gives a hundred dollars more to charity than the second family, then the giving family will earn on average $375 more in income than the nongiving family—and that’s statistically attributable to the gift.”[10]

We love it when science catches up with revealed truth! The Lord will truly bless us financially as we faithfully trust him with the first 10 percent of our finances. Yet, as many can attest, the blessings of paying tithes and offerings may not always be financial; they may come in the form of physical or spiritual protections or blessings. The Spirit has at times whispered to us and to others that certain nonfinancial blessings were directly linked to the discharge of tithes and offerings. Brooks offered this summary of his research, which highlights both the temporal and spiritual blessings of financial giving: “Givers are healthier, happier, and richer.”[11]

The bottom line is this: Paying our tithing and giving generous offerings are the best investments we can make, not only for our family finances but for our spiritual and physical protection as well. God has given us everything. He asks us to give back to Him 10 percent for tithing, plus more for offerings. He then lets us keep the rest. He magnifies what remains and blesses us, especially in our marriage.

Avoid Debt

Some years ago, a short skit was produced on the television show Saturday Night Live with Steve Martin, Amy Poehler, and Chris Parnell called “Don’t Buy Stuff You Can’t Afford.” The skit is full of satire, as Parnell teaches Martin and Poehler about a “revolutionary” plan to get out of debt by introducing a book titled Don’t Buy Stuff You Can’t Afford. Martin and Poehler act dumbfounded and shocked at the idea. Millions of Saturday Night Live viewers laughed and laughed, and each time we watch the skit again, as silly as we think it is, we laugh. As one reviewer put it:

We all have a good laugh at how ridiculous it is, but we’re all kind of guilty of doing the very things we are laughing about—which is why we laugh. . . .

How to buy expensive things using money you save—a common sense principle that so many of us struggle to grasp.

How many of us buy things we cannot afford? . . .

We laugh at the stupidity of the question, “I don’t have enough money to buy something, should I buy it anyway?” . . .

While the video is a good laugh, it teaches the most basic concept in personal finance, living on less than you make and not buying things you can’t afford.”[12]

Like the comedic skit portrays, avoiding debt is one of the great challenges of our time and is a pressure point, particularly in marriage.

We have sought to adhere to the principle taught in this skit. We plan ahead in anticipation of a significant purchase and begin to save. As we anticipated having more children, we realized we would need to move up from our sedan and purchase a larger vehicle. Minivans are pricey, so we began saving several years before we actually needed to make the purchase. When the time came to purchase the vehicle, we wanted to be very careful about using this hard-earned and hard-saved money wisely. We did a lot of homework on what to buy and where to buy. In the end, although it took a lot of research and it caused inconvenience (we had to travel from our home in Utah across state lines to California), we were able to find a used van with very low miles for about half of the cost of a new one and purchased it with saved money. No debt. No monthly payments. And since we found such a good deal, we had extra money left over to use for other desired purchases.

Avoiding debt is easier when married couples consider their finances sacred and seek to “appeal unto the Lord for all things whatsoever [they] must do with them” (Alma 37:16). One piece of counsel we were given during our temple sealing ceremony was to beware of getting preoccupied trying to “stay up with the Joneses” and to be modest in our purchases. We have sought to follow this counsel and have explicitly prayed over the years that our Father in Heaven would help us to “be wise stewards of our financial resources.” This prayer is in line with a teaching from Elder Joe J. Christensen of the Seventy: “Our resources are a stewardship, not our possessions. I am confident that we will literally be called upon to make an accounting before God concerning how we have used them to bless lives and build the kingdom.”[13] We believe that we have been blessed as we have purposefully sought our Heavenly Father’s help to be wise financial stewards. We have been prompted to seek frugality as best we can in order to avoid debt and remain financially sound. This has required the sacrifice of some things we have wanted. However, through patience, financial discipline, and God’s assistance, we have been able to obtain not only the things we need but sometimes the things we want: “Wherefore, let my servant . . . appoint unto this people their portions, every man equal according to his family, according to his circumstances and his wants and needs” (D&C 51:3).

Richard: Sometimes God does make it possible for us to get what we want. When Debra and I first met, I had been house hunting; I was longing to live where the houses were further apart, where I could have some land and a beautiful view. When we got engaged, the practicalities of becoming a husband and instant father compelled me to set that dream aside for a few years. However, my dream continued, and there were times when I would fantasize by looking online for available houses in desirable areas. In time, I found a house and location that I loved. It was not unusual for me to take a little side tour after work and drive past the house “on my way home”—thirty minutes each direction out of my way.

Based on the housing market at that time, purchasing the house would have been a big stretch financially. I pondered how the house could be afforded, and I gathered all of the information I could on what it would cost us to make the move. I contacted the city to inquire about taxes and utilities, I calculated gasoline costs for the extra distance I would have to commute to work, and I talked to people who lived in the area to find out about other costs I had not yet anticipated. Debra and I discussed and pondered all of these things together. Yet, when all was said and done, the only conclusion was that we could not afford, nor justify, making the move. I sadly made the difficult decision to walk away from the house and my dream.

Over the course of the next two years, the economy and housing market dropped. I continued to watch the house’s activity in the housing market from a distance, having a silent hope that the price would drop. I watched as the house went on and off the market and then back on again under contract. Yet, unnoticed to me, it later went back on the market. One day I got online to look at houses in the area, and I was shocked to discover the same house was still unsold. And to my pleasant surprise, its price had dropped significantly—over 25 percent from its original price two years earlier. I couldn’t believe it! I quickly recalculated our finances with the new asking price and found this time that the purchase would fit comfortably within our budget.

Things moved quickly after that. Within two months we had put an offer on the house, negotiated an even lower purchase price (which ended up being the same price we had paid for our then-current smaller home five years earlier at the top of the market), and moved our family into the new home. We felt Heavenly Father had blessed us for having had the self-discipline to walk away from what would have been a heavy and very lengthy financial burden. Yet through patience, homework, couple discussions, pondering, and prayer, we were able to finally purchase the same home, saving a significant amount of money.

This is one of our more dramatic personal financial stories; we have had many smaller experiences in which we walked away from something we wanted because it was not financially wise and never looked back. Most often, when we exercise self-denial, we will not get the desired item, but we are then blessed with greater spiritual or temporal blessings, blessings that are more desirable than the original sacrifice.

Debra: Another example of exercising self-denial came before I met Richard and soon after I became a single mom. I needed to sell my old two-seater car to purchase a car for myself and two daughters. It didn’t sell for very much. Family members offered to lend me money so I could purchase a newer, more expensive car. I was very tempted to accept their offers, but in the end I felt very strongly I needed to follow prophetic counsel to avoid debt. I made the decision to find a car for the same amount I received from the sale of my older car. I did. The car I purchased was reliable, requiring only some minor adjustments over the years I owned it. It met my needs as a single mom, and once Richard and I were married we continued to use the car for some years until it became necessary to purchase our minivan. The blessing I received from denying myself the nicer vehicle was that, in my already-strained financial circumstances as a single mom, I enjoyed the freedom of having my car paid for in full, with no monthly payments to create an additional burden. Then, when we married, Richard and I were free to purchase a home without additional debt to weigh us down.

Prophets have long cautioned us about the discharge of financial stewardships. In the Book of Mormon, we have been counseled by Jacob to “not spend money for that which is of no worth, nor [our] labor for that which cannot satisfy” (2 Nephi 9:51). President Heber J. Grant stated: “If there is any one thing that will bring peace and contentment into the human heart, and into the family, it is to live within our means, and if there is any one thing that is grinding, and discouraging and disheartening it is to have debts and obligations that one cannot meet.”[14] More recently President Thomas S. Monson said this concerning debt:

My brothers and sisters, avoid the philosophy that yesterday’s luxuries have become today’s necessities. They aren’t necessities unless we make them so. Many enter into long-term debt only to find that changes occur: people become ill or incapacitated, companies fail or downsize, jobs are lost, natural disasters befall us. For many reasons, payments on large amounts of debt can no longer be made. Our debt becomes as a Damocles sword hanging over our heads and threatening to destroy us.

I urge you to live within your means. One cannot spend more than one earns and remain solvent. I promise you that you will then be happier than you would be if you were constantly worrying about how to make the next payment on nonessential debt.[15]

With this conservative counsel in mind, we might then ask ourselves the question “Is debt ever okay?” According to financial expert Suze Orman, there is actually “good debt.” She explains, “Good debt is money you borrow to finance an asset. An asset is something that has value today and is expected to rise in value over time.”[16] In today’s world, examples of good debt include such things as a mortgage (as your home is expected to rise in value) or a student loan (as your income will expect to rise with the additional education). She contrasts this to “bad debt,” which is “any money you borrow that is not used to finance an asset.”[17] Examples of bad debt include credit card debt and car loans (remember that the value of your car never rises but always falls). Orman counsels us “to keep the good/

Use a Budget

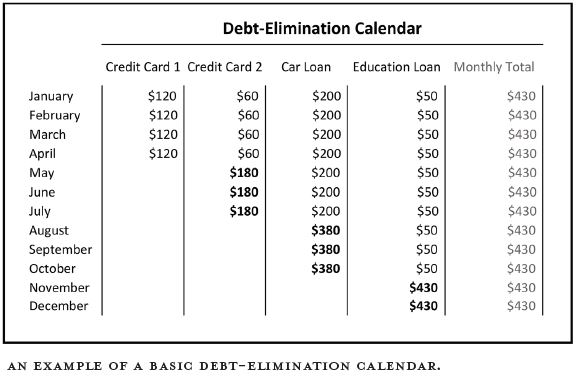

There are many budgeting plans that are available with a simple keyword search on the Internet. They all do the same thing: they help us organize and discipline our finances. A budget is a valuable exercise for all couples, regardless of income level. It is especially important for couples with debt, as developing and holding to a budget is one of the ways to work your way out of debt. A useful financial tool is what is commonly called a debt-elimination calendar. [Side bar 4 approximately here] Here is an example of a basic debt-elimination calendar. [End of side bar 4] This is, in effect, a budgeting method. It establishes a monthly amount of income to go to each debt, starting at the smallest debt and progressing to the largest. Once the smallest debt is paid off, then that amount is carried over to the next-smallest debt until it is paid off. Each time this happens more money is allocated to the next-highest debt, which helps pay it off faster, until all of the debts are finally cleared. For many couples this method has literally saved their marriage. They have been able to get out from underneath what was a heavy financial burden, learning the principle of discipline and planning. We read in Doctrine and Covenants 19:35, “Pay the debt. . . . Release thyself from bondage.”

Debra: Early in our marriage we set up a budget. This took some time and effort and serious negotiation, as we had different approaches to budgeting and using money. Having been single for so many years, Richard rarely had a formal budget. He knew approximately how much money he had in the bank, and he knew it was enough for him to have what he wanted. He easily purchased what he wanted or spent his money on valued activities. On the other hand I was accustomed to being on a very tight budget. I chronically sacrificed wants in order to cover basic necessities; it was an exercise in continual self-denial. So when we sat down to discuss finances, we had to negotiate each other’s beliefs about money and where that money should or shouldn’t go. There was no questioning the basic categories of budgeting, such as tithing, fast offerings, mortgage, food, clothing, fuel, and utilities. But I really struggled to put optional things into our budget—like money for treats, hobbies, dates, family vacations, and the like—when I felt like we couldn’t afford them. It was a patient effort to finish the budget; I had to be much more open to Richard’s thoughts and desires.

Richard: One of the specific budgeting areas we struggled to negotiate when we were first married was allowing for a personal budget for each of us. I wanted a monthly allowance that I could use for whatever I wanted. I wasn’t asking for much, but I wanted personal spending money for things like fast-food lunches or a doughnut when I felt like it. This was hard for Debra, as she saw those purchases as wasteful and felt that I was not being respectful of her efforts to be frugal for our family’s welfare. So, initially, Debra resisted. However, eventually, she came to see that making such a concession was important to me and my personal satisfaction.

With this agreement, Debra also received a personal budget equal to the one we had agreed to for me, although she rarely used it during the early years. More recently, however, when Debra finished having children and lost weight, she started using her personal budget to buy a new wardrobe; I didn’t feel the least concern about her spending when all the new clothes started showing up because I had been using mine for years.

So, through patient and respectful negotiation, we were able to build a budget that included a small personal allowance or “fun money” budget. In this we were able not only to maintain the overall financial control of our income as a couple but also to provide personal spending money. This gave us some autonomy and flexibility and freed us from feeling a need to micromanage one another’s certain purchases. This helped us both avoid unnecessary conflict.

We like the idea that couples should have a personal budget or allowance set up for each spouse. Whether the budget allows for $10 per month per person, $100 per month per person, $1,000 per month per person, or more, we feel strongly that this arrangement creates a needed feeling of independence within the interdependence of the couple’s finances. It also saves a lot of nitpicking or nagging over minor personal purchases. Some couples leave the money in their account and just keep track of the personal-allowance expenditures, some couples cash out the personal allowance so each person has cash in hand, and others transfer money into a personal checking account. We think the arrangement you choose should work with your lifestyle and comfort level.

However, as we speak of setting up a personal allowance, we do not mean that spouses should set up personal bank accounts into which they put the money they personally earn for their own use. When couples do this, generally spouses divvy up the domestic bills for which they will be responsible (for example, “I pay the mortgage/

We have talked with those in this arrangement and have heard resentments. Some have felt responsible to pay more than their fair share of the bills, while others have had bad feelings toward their spouse for withholding money for luxury expenditures when they themselves are struggling to pay for basic necessities simply because there is a discrepancy in earnings. We believe it is important that both spouses have access to and use a central bank account. This places spouses into a position of partnership that will build unity and make them both accountable to each other financially. On his finance show, financial expert Dave Ramsey once responded to the question of separate bank accounts for married couples:

I don’t believe in separate checking accounts in a marriage. I don’t think you need to be independent when you’re married. That’s why they call it married. Independent is called single. If you want to be married, the preacher says, “And now you are one.” Having a single checking account forces you to make your financial decisions together and to be in heavy communication about all aspects of your life. . . .

When someone wants a separate checking account, that is a danger sign not to your money but to your relationship. . . .

One checking account in your marriage forces you to cooperate, forces you to communicate, forces you to be of one mind, and creates a level of unity that is just plain weird. By the way, you will quit writing as many checks when you do this.[19]

We discussed in chapter 6 how the sexual relationship not only is important for marital unity but also is a type and shadow for our relationship with Christ. Here too the same principles of unity with Christ are relevant in the financial relationship we share with our spouse. Working to establish a budget and then honoring that budget will create a strength and sense of unity that will be an asset to our marriage and assist us in creating an eternal quality therein. This type of eternal financial relationship will teach us valuable principles about the relationship we share with Christ; as we become one with Him, we take on His great assets, He absorbs our great liabilities, and we become perfected in Him.

Build a Reserve

Building a reserve, or saving money, is another practice that will bless our marriage. Elder Joseph B. Wirthlin counseled:

Remember the lesson of Joseph of Egypt. During times of prosperity, save up for a day of want. . . .

The wise understand the importance of saving today for a rainy day tomorrow. They have adequate insurance that will provide for them in case of illness or death. Where possible, they store a year’s supply of food, water, and other basic necessities of life. They set aside money in savings and investment accounts. They work diligently to reduce the debt they owe to others and strive to become debt free.

Brothers and sisters, the preparations you make today may one day be to you as the stored food was to the Egyptians and to Joseph’s father’s family.[20]

Building a reserve will require a team effort of consistent self-discipline as a couple. In order to prepare for major setbacks such as unemployment or unexpected medical bills, Orman recommends a savings account that can serve as an emergency cash fund and is sufficiently large enough to cover eight months of living expenses.[21] We have heard others counsel a reserve of six months of living expenses. If these recommendations seem daunting, apply the spirit of the counsel and make a more modest savings plan that seems practical for you. Even if you are saving only a few dollars a month, that effort will add and even multiply; saved money can provide a way to easily pay for an unexpected expense or emergency. When a spouse then loses a job or a car repair becomes necessary, rather than panicking and scrambling to find some money, which often results in relying on a high-interest loan or credit card for cash, a couple can feel peace. As we read in Doctrine and Covenants 38:30, “If ye are prepared ye shall not fear.”

There are several ways to save money. Of course, the most obvious is to designate an amount of savings into your monthly budget. Setting aside a certain amount each month into a savings or retirement account is an important beginning. Couples who consistently add money to one or both accounts will truly reap more than what they sow and will be happy when that rainy day comes.

Debra: Besides saving money from one’s income, there are other less obvious yet successful practices for building a reserve. One of these is to do house projects or car repairs yourself, rather than hiring out labor or services. The saved money can then be put in reserve. Richard was raised on a farm and learned creative handyman skills. He has been willing to utilize those skills to do work around our home in order to save money. Yet he has also been willing to extend his comfort zone to learn how to do things he didn’t already know how to do; he spends time watching how-to videos on the Internet, talking to workers at home-improvement stores, and consulting with others who have done the type of work before. This has been a great effort on Richard’s part because he often works on projects at the end of the day, after a full day’s work, or on a Saturday rather than recreating. Yet he has saved us substantial labor fees. As a result, we have been able to do many home-improvement or car-maintenance projects that we otherwise would not have been able to afford. He also is able to enjoy the satisfaction of a job well done and the pride of knowing he did that.

Another way to build savings is to spend less for the items you need to purchase. At the grocery store, we have been vigilant at price matching, saving significant amounts of money each year, particularly on produce. When we have nonfood item needs, Debra will first try to buy the item from a thrift store, buy it from a yard sale, or buy it used online at a reduced price before purchasing it at full price from a retail store. When Debra needed an entirely new wardrobe after having our children, she was able to purchase previously owned yet like-new brand-name clothing online for about a third of the retail price. In addition Richard began to purchase his eyeglasses from an online store at a quarter of the price that he would pay at the optometrist’s office. He has also found ways to save money on our monthly bills, such as refinancing the mortgage to get a better interest rate, saving on cell phone contracts and home phone bills by using online services, and choosing not to have cable television. All of these practices keep money from leaving our bank account and thus becomes saved money.

We have felt very blessed by our Father in Heaven in our efforts to save money as we have found these and additional opportunities for doing so. We also feel these financial practices have brought us closer together in our marriage. Being business partners in running our family brings great satisfaction that has unified us.

Teach Family Members

Following the above financial principles will bring great peace into our marriages, but all is not done until we teach our children their value. Teaching our children can be done naturally through daily interactions and family councils. Orman teaches that “your children’s real education about money will take place all through their childhood, in the way you talk about money, in the way you present what working is all about, in the way they learn what they have a right to hope for in this world.”[22] Elder Robert D. Hales explained how he and his family worked together on family finances:

When our boys were young, we had a family council and set a goal to take a “dream vacation” down the Colorado River. When any of us wanted to buy something during the next year, we would ask each other, “Do we really want to buy that thing now, or do we want to take our dream trip later?” This was a wonderful teaching experience in choosing provident living. By not satisfying our every immediate want, we obtained the more desirable reward of family togetherness and fond memories for years to come.[23]

One of the most effective ways to teach our children about finances is to practice what we preach. Orman counsels parents to include the children in the formal financial process; this will ensure that they learn to not only live the principles but also value them. She recommends involving children in the family finances once they turn age twelve or so: “Have them sit with you as you pay the bills—not to make them feel grateful for what you provide, but so they have an understanding of what life costs.”[24] She then suggests that as part of having your child involved in the paying of the bills, let them guess the family’s monthly electric bill, and when they see what it actually is “you might find that he or she will think twice before leaving lights on or the TV on after leaving the room.”[25]

We learned principles of financial responsibility in our young adult years. Our parents assisted us with the payment for our LDS missions, which was a great blessing to each of us. Beyond that, we were responsible ourselves to find our way financially as young adults.

Richard: After my mission my father presented me with an old family car that I used as I went off to attend college at BYU. I received no other financial help from my parents. In fact the old family car only lasted one month, and then I had to use money from my fast-food job to purchase another old used car. I used grants, student loans, and part-time jobs to support myself through my college years. I learned never to spend more money than I earned.

Debra: I also attended school at BYU. Since I moved into dorms with a kitchen as a freshman, my parents took me to the grocery store and offered the groceries as a gift as I began my new life as a college student. I paid for my college tuition, books, housing, and food by taking out student loans and working part-time (glamorous kitchen and bathroom) jobs at the university. When my friends who had their tuition and housing paid for by their parents went out on the weekends, I assessed the cost of the activity and often thought to myself, “Do you know how much bread and milk I could buy with that money?” or “Do you know how many hours I had to work to earn the money for that?” I usually did not go with them. These were difficult times learning to be financially independent, but to this day I attribute much of my financial conscientiousness to this hard-knocks training in early adulthood.

Transferring this type of teaching to our children will not only help them but will protect us as a couple from financial burdens imposed by our own children later. Our children’s financial practices can come back to haunt us, creating a great deal of strain on our finances and our marital relationship. For example, some adult children have learned they can sponge off of parents without accepting their own financial responsibility. Of course there are times when it is entirely appropriate to assist adult children with their financial difficulties. However, in some families this has become a rule rather than an exception. In a BYU devotional, Elder Neal A. Maxwell discussed: “A few of our wonderful youth and young adults in the Church are unstretched—they have almost a free pass. Perks are provided, including cars complete with fuel and insurance—all paid for by parents who sometimes listen in vain for a few courteous and appreciative words. What is thus taken for granted . . . tends to underwrite selfishness and a sense of entitlement.”[26]

Debra: I have worked with several clients in the situation described by Elder Maxwell and have seen how the overly liberal giving of parents only continues to feed the dysfunction of the child. Despite the financial safety nets offered by the parents, the unhealthy children generally continue to sink lower and lower into dysfunction because the parents have maintained accountability for the child’s finances without transferring responsibility to them in adulthood. I have unashamedly counseled parents in this situation, “Shower your child with love and support, but close your pocketbook.” Through this process, the child can become responsible to make or break their own financial life. This type of intervention also allows parents to be able to influence and teach even adult children the importance of financial responsibility.

How can we decide when it may be appropriate to financially help our needful adult children, without it putting a strain on our marriage? In the area of your adult children’s finances, this becomes most complicated, fraught with powerful emotions and parental instincts. Of course we seek to be generous in our offerings to the Lord and to others, yet some practical guidance about generosity may also prove helpful as we consider trying to teach our family members about financial responsibility. Orman counsels, “It is very important that you understand that true generosity is as much about the one who gives as it is about the one who receives. If an act of generosity benefits the receiver but saps the giver, then it is not true generosity in my book.”[27] She then provides six rules to follow relative to honest giving:

- You give to say thank you and out of pure love. Not to get something back.

- Whether it is a gift of time, money, or love, you must feel strongly that your gift is an offering.

- An act of generosity must never adversely affect the giver. [And Debra would add here that it also must never adversely affect the receiver—such as enabling irresponsible or immature behavior.]

- An act of generosity must be made consciously.

- An act of generosity must happen at the right time.

- An act of generosity must come from an empathic heart.[28]

Thus, giving to our adult children should be a win-win, injuring neither party.

It then follows that, in teaching our children, sometimes we will need to say, “No.” This can be difficult to do, but when we feel it is appropriate to do so it can be done in a loving way: “I love you and support you, but if I were to help you financially right now it would actually limit your ability to become independent. I need to let you work this one out for yourself.” If you have made a habit of rescuing your adult children financially, it will be difficult to change course, yet even one courageous moment in which you choose to do things differently can set your child on a new path. So as not to appear punishing when initially making the shift, you can take the issue upon yourself: “I can’t help you financially this time. I know I have always said ‘yes’ before, but I feel I have actually hurt you by doing so. I apologize for limiting your growth and hope you’ll forgive me. From now on I need to let you become more responsible for these things.” This type of true generosity will allow love to flourish, as well as teach your adult children financial values.

There may be occasions when an adult child needs to move back into a parent’s home. Regardless of the reason, this cannot become a free-for-all. The parents need to ask the child, “What is your plan? What is the timeline?” Establishing expectations is a very important part of helping our child. By doing this, we eliminate or reduce the potential stressors that might come between us and our child as well as between us and our spouse.

Teaching family members proper financial habits will establish proper boundaries, encourage fiscal responsibility, and provide tools for financial survival. Yet, more importantly for our purposes here, it will also immeasurably bless our marriage. When children come to us with a sense of entitlement that we fund their personal wants or even fix their perpetual financial problems, those circumstances can create a great deal of stress and even interpersonal tension in our marriage. At those times, the drama may often become all-consuming as we try to negotiate the best way to handle the situation. That strain can significantly drain the positive energy we need for our relationship, siphoning our energies away from our relationship to focus on the problems of the child.

And in some cases our adult children’s financial dependence becomes a frequently repeated endeavor that over many years becomes dysfunctional and taxing at ever-increasing levels. When we teach our family members principles of financial responsibility, we preserve precious time and positive energy for us as a couple.

Conclusion

Deuteronomy 2:6 reads, “Ye shall buy meat of them for money, that ye may eat; and ye shall also buy water of them for money, that ye may drink.” Thus, managing finances is imperative to take care of our living needs. In marriage the task of managing our finances falls upon both of us as a couple. As we do this, we must learn how to work peacefully with each other while honoring each other as equal partners. If we do not, our marriage will be in severe jeopardy, as financial arguments are one of the strongest predictors of divorce. Yet couples who communicate often about their finances, work together, respect each other for their unique marital contributions (regardless of financial compensation), and show flexibility will be more likely to succeed in marriage not only interpersonally but financially as well.

Applying the five principles outlined in this chapter will provide a good foundation for financial solvency. Maintaining a disciplined effort to pay tithes and offerings will bring the acceptance and blessings of heaven. Avoiding debt protects a marriage from the heavy burdens of interest and bankruptcy. Budgeting provides a couple with a financial roadmap, saving money makes it possible for a reserve when that rainy day comes, and teaching children appropriate money practices protects couples from future financial burdens.

Couples will have to work hard, discipline themselves, and be patient with each other over financial decisions and practices. In the end, temporal blessings will come as we navigate finances together. We will also receive spiritual blessings and strength to our marital relationship as we improve unity, respect, and trust between spouses.

Notes

[1] Jeffrey Dew, Sonya Britt, and Sandra Huston, “Examining the Relationship Between Financial Issues and Divorce,” Family Relations 64, no. 4 (October 2012): 615–28.

[2] Marvin J. Ashton, One for the Money: Guide to Family Finance (Salt Lake City: The Church of Jesus Christ of Latter-day Saints, 1992), 3.

[3] Suze Orman, Women and Money: Owning the Power to Control Your Destiny (New York: Spiegel and Grau, 2007), 220.

[4] Orman, Women and Money, 221.

[5] Orman, Women and Money, 221.

[6] “The Family: A Proclamation to the World,” Ensign, November 2010, 129.

[7] “Tithing,” The Church of Jesus Christ of Latter-day Saints, 2015, https://

[8] Spencer W. Kimball, in Conference Report, April 1974, 184.

[9] G. Q. Morris, “Perfection through Obedience,” Improvement Era, June 1953, 435–36.

[10] Arthur C. Brooks, “Why Giving Matters” (devotional address, Brigham Young University, Provo, UT, 24 February 2009), https://

[11] Brooks, “Why Giving Matters.”

[12] Mark, “What I Learned from an SNL Skit,” Debt-Free Mormon (Blog), 14 March 2014, http://

[13] Joe J. Christensen, “Greed, Selfishness, and Overindulgence,” Ensign, May 1999, 11.

[14] Heber J. Grant, Gospel Standards: Selections from the Sermons and Writings of Heber J. Grant, ed. G. Homer Durham (Salt Lake City: Deseret Book, 1976), 111.

[15] Thomas S. Monson, “True to the Faith,” Ensign, May 2006, 19.

[16] Orman, Women and Money, 95.

[17] Orman, Women and Money, 95.

[18] Orman, Women and Money, 96.

[19] Dave Ramsey, “Dave’s Take on Separate Checking Accounts,” 2015, http://

[20] Joseph B. Wirthlin, “Earthly Debts, Heavenly Debts,” Ensign, May 2004, 42.

[21] Orman, Women and Money, 76.

[22] Suze Orman, The 9 Steps to Financial Freedom: Practical and Spiritual Steps So You Can Stop Worrying (New York: Three Rivers Press, 2000), 298.

[23] Robert D. Hales, “Becoming Provident Providers Temporally and Spiritually,” Ensign, May 2009, 9–10.

[24] Orman, Women and Money, 226.

[25] Orman, Women and Money, 226.

[26] Neal A. Maxwell, “Sharing Insights from My Life” (devotional address, Brigham Young University, 12 January 1999), https://

[27] Orman, Women and Money, 50; emphasis in original.

[28] Orman, Women and Money, 51.